Small Value Needs an Active Spin

- Johann Colloredo-Mansfeld

- Oct 1, 2024

- 3 min read

Investing in small cheap companies has generated high average historical returns. This phenomenon has been replicated across countries and corroborated with substantial out-of-sample evidence. In recent years, however, the returns to investing in this corner of the market have been underwhelming. While the causes underlying this weak performance may be difficult to pinpoint, data show a potential remedy. Small and cheap companies that implement certain practices in capital allocation – paying down debt, buying-back shares, and limiting asset growth – meaningfully outperform their less financially prudent peers.

Figure 1 shows the returns to a small value strategy over the last two decades relative to the Russell 2000. In this historical sample, the data show that while a small value strategy generated high excess returns from roughly 2002 - 2013, it has essentially flatlined since then.

Figure 1: Russell 2000 and Small Value Returns, June 2002 – November 2022

Source: S&P Capital IQ, CRSP Compustat

Note: The ‘Small Value’ strategy is the cheapest quintile of small cap stocks (<$2B market cap) based on TEV/EBITDA

Academics have tried to explain this recent underperformance by pointing to the rise of intangible assets, the increasing importance of ESG mandates, and the non-stationary nature of financial returns. A recent quote from David Einhorn of Greenlight Capital indicates that practitioners are equally stumped:

“What we’re doing now is we’re saying what do we have to do to make a good return if a tree falls in a forest and nobody is there to hear it? What happens if there aren’t other investors who are going to bid up the stocks and figure out what we have figured out after we figured it out, because that’s what we used to do.” – Money Maze

In other words, as money has moved from active to passive vehicles, cheap companies have tended to remain cheap in the absence of marginal buyers. So who's left to price capital among this "wasteland of companies", as Einhorn calls it. One potential answer is that prudent management teams have begun to take up this role. Figure 2 below shows two strategies, one that invests in small cheap companies and another that invests in small cheap companies that are also paying-down debt, buying-back shares, and limiting asset growth. The area bar shows the cumulative difference between these two strategies, which began to diverge in 2012.

Figure 2: Small Value and Simulated Capital Allocation Returns, June 2002 – November 2022

Source: S&P Capital IQ, CRSP Compustat, Countervail Analysis

Note: The ‘Small Value’ strategy is the cheapest quintile of small cap stocks (<$2B market cap) based on TEV/EBITDA

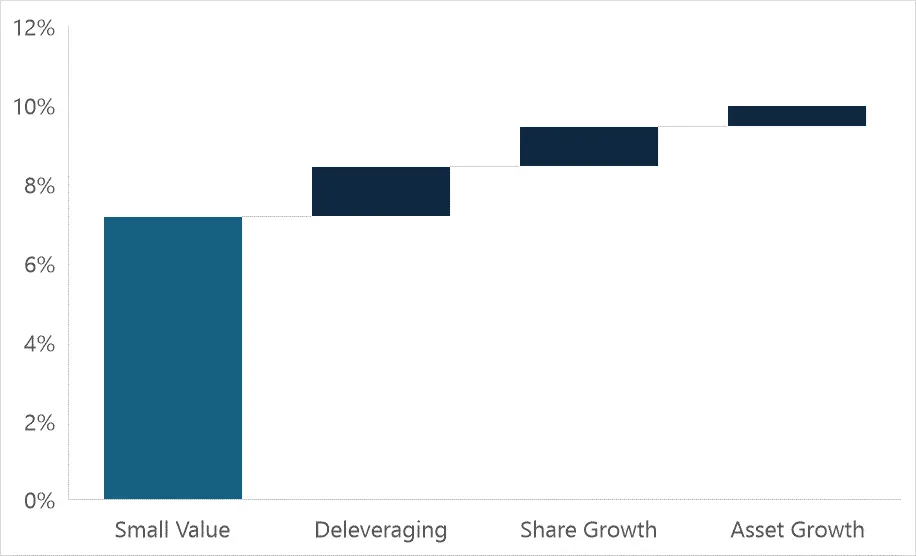

The data seems to support Einhorn's idea that value investors cannot simply rely on the buying behavior of other investors who see the opportunity to participate in the correction of a mispriced company. Rather, investors now depend more on managers of these businesses to take on this role and drive shareholder returns through sound capital allocation practices. Figure 3 shows incremental returns earned over a pure small value strategy driven by debt-paydown, share buybacks, and changes in asset growth. The deleveraging factor improves pure small value returns by 1.2% annually, the share buy-back factor by 1.0% annually, and the asset growth factor by 0.5% annually.

Figure 3: Simulated Return Decomposition to Capital Allocation, June 2002 – November 2022

Source: S&P Capital IQ, CRSP Compustat, Countervail Analysis

Note: The ‘Small Value’ strategy is the cheapest quintile of small cap stocks (<$2B market cap) based on TEV/EBITDA

Whether it’s the rising importance of intangible assets, a shift in investor preferences toward green assets, the noisy and stochastic nature of financial time series, or an atrophying active management industry, small-value strategies have fallen short of expectations in recent years. Data show that the prototypical small-value strategy can be improved by incorporating a view on a firm’s capital allocation policies. Notably, the prevailing market environment nearly requires managers to approach their own firm as an active target. Taking a combative view towards one's own uses of capital may seem odd, but it does appear likely to drive shareholder returns.

Disclaimer:

The information provided in this research report is for informational purposes only and should not be construed as financial, legal, or investment advice. The opinions expressed herein are based on the author's analysis and should not be relied upon as a specific recommendation to buy or sell securities or other financial instruments. Readers are encouraged to conduct their own due diligence or consult with a qualified financial advisor before making any investment decisions. Countervail Capital and the author assumes no liability for any losses incurred based on the information provided in this report.