Capital Allocation and Industry Competition

- Johann Colloredo-Mansfeld

- Oct 10, 2024

- 3 min read

The firms most likely to engage in capital allocation tend to operate in more concentrated industries

Previously, I wrote how analyzing accounting data can improve our ability to forecast which businesses are most suited for capital allocation. Here I turn to a different source of predictive information: industry structure. I explore the potential for an interaction between a firm’s competitive environment and its ability to effectively allocate capital. The data show that, on average, the firms most expected to engage in capital allocation operate in more concentrated industries.

Economist Joseph Schumpeter is likely the original proponent of the idea that new innovations disrupt stultifying markets in a process of ‘creative destruction’. These cycles of innovation force change on a firm’s competitive environment and would naturally impact capital allocation behavior. The Herfindahl-Hirschman Index (HHI), which sums the squared market shares within an industry to generate a measure of its concentration, provides a simple measure for assessing how a firm’s capital allocation capabilities might change with industry structure and competition over time. Generally speaking, more concentrated industries tend to be less competitive.

To test this empirically, I use industry codes available in the CRSP Compustat merged database and follow Hou and Robinson (2005) to assign each firm an HHI score based on its market capitalization and 4-digit SIC membership. This yields roughly 325 distinct industry classifications each year from 2000-2022. It is important to note that every firm within a given industry receives the same HHI score. Figure 1 summarizes this data and highlights the most and least concentrated industries in the data set in 2010 and 2020.

Figure 1: HHI Summary Data, 2010 and 2020

Source: CRSP Compustat, Countervail Analysis

Note: Differences between market cap- and sales-derived HHI are negligible

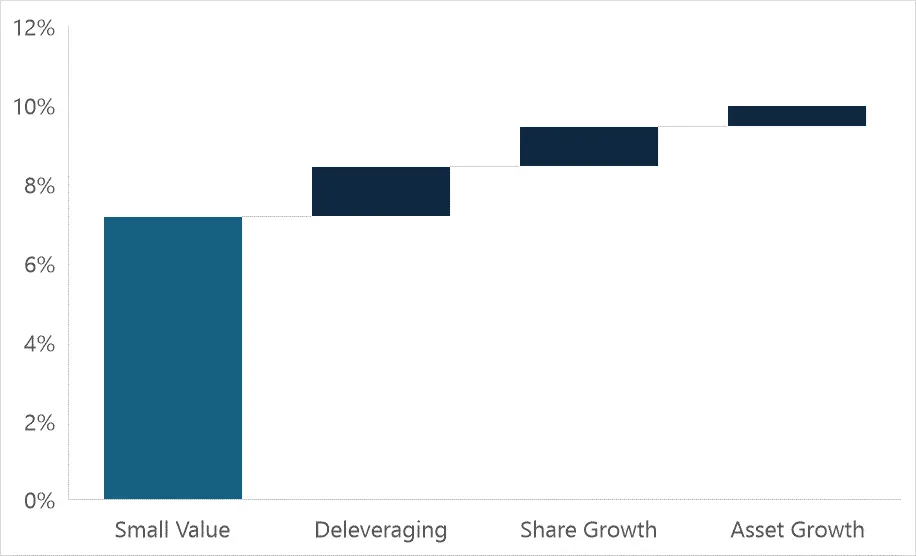

Subsequently, I create portfolios sorted by each of our target capital allocation variables – changes in total assets, goodwill, common shares outstanding, and long-term debt – and calculate the average concentration of the top and bottom quintile portfolios for each variable. Figure 2 shows the average concentration for the Q5 and Q1 portfolios by target variable and year. The Q5 portfolio for change in total assets, goodwill, and common shares outstanding appears to comprise a group of firms operating in more concentrated industries than does the Q1 portfolio. Notably, there does not appear to be any meaningful difference in concentration between the Q5 and Q1 portfolio for change in long-term debt.

Figure 2: HHI of Q5 and Q1 Portfolios by Target Variable

Source: CRSP Compustat, Countervail Analysis

Note: HHI scaled to 0-1, where 0 = perfect competition and 1 = monopoly

I use a two-sample t-test to ensure that the differences in concentration across quintiles are statistically significant. Figure 3 shows the results of this test, which confirm our initial intuition: the concentration differences between the top and bottom portfolios formed on the changes in total assets, common shares outstanding, and goodwill are statistically significant while the difference between the top and bottom portfolios formed on the change in long-term debt is not.

Figure 3: Tests for Significance between Q5 and Q1 Portfolios among Target Variables

Source: CRSP Compustat, Countervail Analysis

Note 1: Comparisons are based on within-year means

Note 2: Non-parametric tests for independence yield comparable results

In sum, the data give some credence to the idea that a firm’s capital allocation behavior does change with the competitive environment of its broader industry. While its difficult to establish any causal relationship here, we can say with some statistical confidence that we are more likely to find the firms that most limit asset growth, changes in goodwill, and share growth in more concentrated industries. This information provides yet another tool to systematically evaluate a firm’s capital allocation behavior.

Disclaimer:

The information provided in this research report is for informational purposes only and should not be construed as financial, legal, or investment advice. The opinions expressed herein are based on the author's analysis and should not be relied upon as a specific recommendation to buy or sell securities or other financial instruments. Readers are encouraged to conduct their own due diligence or consult with a qualified financial advisor before making any investment decisions. Countervail Capital and the author assumes no liability for any losses incurred based on the information provided in this report.